|

Audio has been my new obsession for at least the last three years. I did this shoot out with a grand piano to see how different mics sounded with different techniques and distances. It's a simple test, but it paints a good picture of how small changes can make for a totally different sound recording.

First I tested a pair of AKG C451B small diaphragm cardioid condensers. These are my "fancy" mics, so I used them in an A/B technique, which is right inside the piano, 8-inches away from the piano wires, and just over 24-inches away from each other. One mic is positioned close to the hammers over the treble clef strings, the other centered halfway up the bass clef strings. I was initially worried about there being a lack of "attack" on the low notes, but I was absolutely satisfied with how this sounded. This is great for pop, rock, country, blues, etc. Basically anything but classical. The C451 mics are really flattering for high pitched frequencies. They are the industry standard for recording hi-hat cymbals, for example. They articulate sounds over 5kHz. The low end on these mics slowly sinks below the 150kHz mark, which is totally fine most of the time. In fact, they have low pass filters to cut out the mud below 75Hz or 150Hz. These are great mics for any instrument focused on the notes C2, and especially above C3, with extra clarity on the high notes above C8. If the extreme low notes of the piano are frequently being utilized, I'd say these might not be the right tool for the job, but since most of these piano performances didn't stray very often below C3, they work well! The next setup was an X/Y technique using a pair of Line Audio CM4 small diaphragm cardioid condensers. The X/Y technique is when the two mics capsules are right on top of each other, pointing out at a 90° angle. This had less phase issues (basically none) than the A/B method (no phase "problems" but it's a little less than perfect). These were positioned outside of the piano, not that far away. But the sound is very different. The CM4 mics are same type of mics as the C451B, but with a much flatter response. They capture all the low, middle, and high end frequencies very neutrally. There is "truth" to them, but they don't boost or pass anything you might want boosted or passed. Finally, just to get an idea what kind of room this was all recorded in, there is a single Røde NT1 large diaphragm cardioid condenser positioned pretty far away. You're hearing mostly reflections of the sound with this mic. This by itself would be "bad" but blended in with the others, like an effect, it is "good."

0 Comments

Why do I have this urge to simplify people? I'm pretty sure it's because judging people is incredibly exhausting. And let's face it; we judge people all the time. When we do it at the primal level we try to assess if someone is a threat to us. That means we need to do it fast. We need to observe as much about the subject as we can, cross-reference that to information we already have, and do that in the shortest amount of time possible. Our brains do this automatically to avoid being murdered, and so you can't really be mad at that. But beyond the primal instincts, judging people to understand their character really requires a lot of work and the only way you can do it without being a jerk is to put the work in. I think this is why we generally associate "being judgey" as a negative characteristic. Specifically that most of the time most people are lazy about it. The more time and effort you put into understanding another person's perspective, the more understandable their mindset and actions will be. I mean, what's negative about that? Nothing. That's why I think when we say someone is "judgey," what that really means is that they judge lazily. If everyone has an infinite amount of time, energy, and the desire to do so, we could all come to a universal truth about morality and how to classify everyone's character. In this impossible situation, very few people would likely fall into the asshole category, because there would be a handicap of understanding on every person. It would be like a giant game of golf where almost everyone ties for 1st place, because truly understanding who they are would apply an empathy handicap. And so it would seem like I already know that I can't lump people into categories like this. And yet, I still feel the lazy primal judgey urge to do it. My newest thought is that I need to reframe the sorting process. If it lands on me to judge the subject's actions, I could be observing them incorrectly. If it lands on me to judge my own interpretation of their actions, that seems like it could be a truer verdict. It's really more about deciding how I see people, not deciding who people (that I don't truly know) really are. This never-ending work in progress leads me to my newest categories. Yes, i've tossed out Assholes and Not Assholes, and I've replaced them with this over-worded complicated grading scale:

Here is the twist. It's not your typical 1-5 scale where 1 sucks and 5 is awesome. I actually think 2 is far worse than 1. All humans are ignorant about most things. While ignorance is not a virtue, it isn't "wrong" to not know something. Because the solution to not knowing something is to learn it. And if your only problem is that you have no idea that you are making other people's lives worse, than you can learn that, and correct it. However, if you do learn it, and choose not to correct it, then you have moved on to #2, which is clearly in the "asshole" category. I'll even go as far to say that we shouldn't expect everyone to be a #5, either. Simply because what you THINK is positively affecting one person or group might actually be negatively affecting a different person or group. And so an attempt at #5 might actually land you at #3. No, where we should all be, and also expect from each other, is #4. I think what I was trying to do with the 2-group sorting system of Assholes and Not Assholes, was basically saying "Are you a 2 or a 4?" But that didn't take into account ignorance, intentions, and most importantly how I observe them. A #1 could mean the subject is ignorant to their effects on others, but a #1 could also mean that I AM NOT OBSERVANT enough to detect how subtle the subjects mindful actions are. It really puts it back on me. It's not "What kind of person is this?" but rather "How well am I seeing who they really are?"

A Song (and An Album) About Addiction

The opening track from our seven song EP has upbeat rhythms, pop melodies, happy harmonies, and lyrics about killing yourself against your own will.

No doubt the album was dark under the camouflage of pop-rock. That was the style we went for. Unfortunately the lyrics were our life stories.

On drums and backing vocals is the late Rob Ison: A hard-hitting drummer with a grunge-styled voice. Also a man battling some of the worst kinds of addiction you can imagine when you think of the word. Rob had written some of the lyrics on some of the other tracks, and Anything Done Differently was the last song I wrote just days before going into the studio. It almost wasn't on the album.

Anyways, Rob had written some pretty dark stuff in the other tracks. When it came to "smashing up blue pills," I just couldn't relate. I had been straight-edge for all of my youth and to this day I have never smoked marijuana. But what I have done (and become addicted to) is eating dangerous amounts of food with a dangerously sedentary lifestyle. I'm sure many of you wouldn't compare an unhealthy diet to a drug addiction, but if it kills you it has the same ultimate effect.

I wrote the lyrics to Anything Done Differently about how when you keep trying and failing, you eventually give up. Or you eventually succeed. But it's hard to imagain succeeding, when all you know is failure. When every single attempt has resulted in giving up, why then would it be any different for the next attempt? I had been motivated every time in the past. Why would the next motivation yield any different a result? I wrote these lyrics in a generalized way, so that Rob might relate to them. He loved them.

In fact, I hope I haven't painted the picture that Rob passed away from his addictions. No, he fought his battles and won. He got clean and fixed his life and is one of the few success stories out there. I never got the chance to tell him how proud I was of him. Tragically, Rob was killed in a work-related accident. The world is not fair. As depressing as these lyrics are and what they mean to me, I have since learned that with 1,000 failures, it only takes a single success to show you that it's possible. Rob's story, be it cut too short, was a success story and enough to show me that I can see how this time things can be done differently. I gotta have it because I want it because I need it.

So far in this post, there has been no mention of bassist (and my wife) Desiree Marszalkowski. Well, she is (and has always been) as squeaky-clean as her bass playing, so there isn't much else to say about her for this song. I do want to talk about some of her awesome bass riffs from other songs, so we'll get to those on another post.

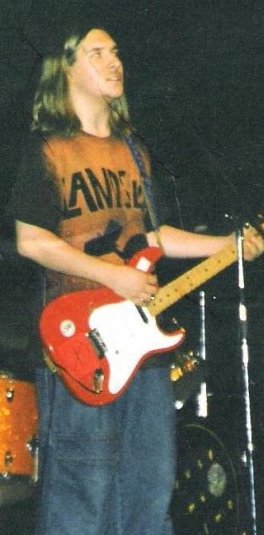

The Miramar Theatre, Milwaukee WI, July 30th 2010 The Miramar Theatre, Milwaukee WI, July 30th 2010

Back when we wrote and recorded this song, we were a three-piece. I was singing lead while playing guitar. Rob was singing backup while playing the drums. Dez was playing the bass and making the least amount of mistakes.

After we finished up the recording, we realized we would need a second guitarist. We had recorded some three-part harmonies and most of the songs ended up having two guitar parts. We brought on Jerry, but he is not on either album. He was there for what seemed like most of the band's shows, though.

One thing I remember about the recording process with this song was that it was done, all our parts were laid out, and Shane Olivo was mixing it. He called me up and asked if I could come back in and do more guitars. I said "I don't have any more parts. Just those chords and the solo that I did already." He said "Oh, I know, just come back and do your parts again. Do them like five more times or something."

If you watch the video below, you'll see that I am playing on a variety of guitars. That's not for the video. None of that was. That was just us filming ourselves recording and playing shows. You'll see I played a my ESP, Shane's PRS, Fender Stratocaster, Guild, Fender Jagstang, and Accoustic. Shane liked to layer stuff more and more into a song, so by the time you get to the last chorus of the song, there is no doubt you are listening to SIX guitars all play the same thing. The ESP ran into my amp and cab, but the other five guitars all likely had different amps and/or virtual-amps. If you're wondering how to get that thick guitar tone, I really have no advice for you. At the root of it is an ESP LTD with Seymour-Duncan pickups and a Mesa Dual Rect-o-verb with the matching 212 cab. The rest is just a pile of diverse fuzz.

Composition wise, we layered the harmonies the same way. In the first chorus, there is not much harmony. Rob is singing a few root notes under the melody. It's pretty backed off. In the second chorus and breakdown, the melody moves up a minor third on the second syllable of the word "differently" while Rob sings the original note from the first chorus. This makes the resolve 2 third harmonies: the first harmonizing with the guitar chord root note, and the second harmonizing with the first.

I LOVE third-harmonies. I use them A LOT. Now, where it get's weird is on the last couple choruses after the breakdown. I add in these long high notes and I did this to make it sound a little creepy. I wanted the lyrics "I can't" to be dissonant. They are sung atop all the other parts on a diminished 6th of the guitar's chord. The "see" that follows "I can't" is a 7th to the root note of the chord that followed. That last added harmony was added because this song sounded way too damn happy. I mean, part of what makes it catchy is that it sounds happy, but those depressing lyrics were hiding in plain sight. It needed something to remind the listener: Something is wrong and nothing has resolved. But that's the "I can't see" side of the lyrics. There is resolve, and it resolved at the very end with "done differently." I like to think that's what the harmonies represent. What starts off feeling uncomfortably impossible can still have a happy ending. Hey. I've Wrote Some Songs.

Landslide (1997-2000)(The) Orphonic Orchestra (2001-2008)The Bard Adherents (2008-2009)The Everyday Motive (2009-Current?)"Anything Done Differently" - Seven Song EP

I feel compelled to try and write something to "sell you" on my upcoming book, so here it goes. ;-)

For Starters...

Ready for the ridiculous title? It's called...

BUY MY BOOK:

|

|

Why This Book Is Important To Me...

- I struggled in the public school system because of my ADHD, and because of that I was not prepared to enter college, and I ended up dropping out. I've never received any good grades in any English or Literature classes, and so I had convinced myself that I was...

- Too illiterate to write a book

- Too uneducated to be an authority on any subject

- It took me years to talk myself into writing a book, and I'm glad I did. It was really fun. The people around me were all very supportive. I think EVERYONE should write a book.

- The idea of dying unexpectedly and having my daughter grow up not remembering who I was, gave me the motivation to start this and even more motivation to finish it. I hope to live into my 100's, but you never know. This book is an insurance policy that no matter what, she will know who her 36-year-old dad was, and what was important to him in 2018.

- I want to use some of the total proceeds from this book to help fund my daughter's education savings plan.

Why This Book Might Be Important To The Community...

- This book is proof that any idiot can write a book and sell it, no matter how dumb they are or how dumb the book is... that's inspiring, right?

- I created Barf-Bag Publishing as a joke (because a dumb-named publishing company still sounds better than "self-published"), but I will honestly help any amateur authors get their book in print. I'd love to see Barf-Bag Publishing eventually offer a long list of authors who don't take themselves too seriously. But I'm getting ahead of myself.

- This book features over 20 illustrations from a wide variety of artists, most of which are Milwaukeeans.

- I hope to use some of the proceeds from book sales to contribute to a scholarship program. Ultimately, I want 100% of the proceeds from this book to help kids get a better education than I did.

If you want to stalk me, I'd be flattered. This is me: http://isthis.work/

Thank you so much for your time!

John Edward Marszalkowski

Just a heads up that i'm still actively writing content. The reason you haven't seen blogs here for awhile is because i've been focused on writing my first book

"BUY MY BOOK: Not Because You Should, But Because I'd Like Some Money. "

As of today, i'm 130 pages in so far. It feels like it might be about halfway done, but i'm not entirely sure yet just how much longer I want to keep rambling on.

Cover design hasn't begun yet, but Jason Gierl has agreed to design it.

Liz Lincoln Steiner will be editing it when it's done.

Linda Steele Giacchino (writer of "IBIS" published in 1985 by Penguin Books) will be writing the forward.

I'm considering LuLu.com for self-publishing, but i'm also open to suggestions for people with experience self-publishing their own books.

I'm pretty much in love with the 6x9" trade case-wrapped hardcover. I don't think i'm going to go the dust jacket route. What are your thoughts on dust jackets?

Due for sale/release on Black Friday 2018. I'll likely be doing preorders... perhaps with Kickstarter or something like that.

So, yeah, don't expect to see many blogs here in the meantime. The book is very blog-like, so it's sucking up all of my ideas.

"BUY MY BOOK: Not Because You Should, But Because I'd Like Some Money. "

As of today, i'm 130 pages in so far. It feels like it might be about halfway done, but i'm not entirely sure yet just how much longer I want to keep rambling on.

Cover design hasn't begun yet, but Jason Gierl has agreed to design it.

Liz Lincoln Steiner will be editing it when it's done.

Linda Steele Giacchino (writer of "IBIS" published in 1985 by Penguin Books) will be writing the forward.

I'm considering LuLu.com for self-publishing, but i'm also open to suggestions for people with experience self-publishing their own books.

I'm pretty much in love with the 6x9" trade case-wrapped hardcover. I don't think i'm going to go the dust jacket route. What are your thoughts on dust jackets?

Due for sale/release on Black Friday 2018. I'll likely be doing preorders... perhaps with Kickstarter or something like that.

So, yeah, don't expect to see many blogs here in the meantime. The book is very blog-like, so it's sucking up all of my ideas.

When I watch those reality tv shows that showcase examples of extreme hoarding, it always makes me feel better about myself. However, justifying my own behavior by simply comparing it to more extreme behavior doesn't mean I don't have a problem. The same way that show "My 600-Pound Life" doesn't make me healthy, watching extreme hoarding shows doesn't make me a minimalist.

Now, I ADMIRE minimalism. I really do. And watching examples of minimalism has the opposite effect on me that watching a hoarding show does. I see examples of minimalism and then I feel really bad about myself. I suppose if I were to tell myself to "not feel bad" after watching a show about minimalism, good health, or other admirable behaviors, then it would only be fair to tell myself "But don't forget that you SHOULD still feel bad" after watching their opposites.

But behaviors like hoarding seem to only be a problem when the negative effects are visible to others. When a house is overflowing with stuff and there are no floor or surface areas left, that's when we say "DAMN! THAT'S MESSED UP!" However, we don't say anything in the early stages. I often think about how organization is kind of a way of enabling hoarding. For example, a giant stack of old bills and receipts stacked on top of the microwave makes a viewer say "Why don't you just throw those out?" However, put them in files and sort those into a filing cabinet, and suddenly that's responsible behavior. We don't ask to see the dates on those bills, because they look like they are where they belong. The same thing goes for clutter. Does it make it okay to have stuff you don't need by organizing it into boxes, labeling those boxes, and then stacking them on nice shelves in your basement?

That's what makes me think perception is about space, not behavior. If you walked into an immaculately clean home, you might not think there is anything wrong. What you don't see is that the owners of that home might have 3 storage units full of stuff they "cleaned" out of their house. Without the storage units, the same amount of stuff might have looked concerning in that home.

And what's up with collections? Where is the line in the sand between collecting things and hoarding? That again seems to fall into the realm of perception. For example, i've never seen any guitarists looked at negatively for having 12 guitars, even though you can only play one at a time. A home library with a large collection of books is considered elegant, but without the shelves, a stack of boxes filled with books makes you ask "why don't you just drop those off at Goodwill?" It would seem the organization of "stuff" absolves it from being clutter, even though it's the same behavior.

So am I a hoarder because I own things that don't constantly bring me joy or function? Would the answer be "no" if I move into a larger home? Would the answer be "yes" if I moved into a smaller home?

I don't think i'm a hoarder as much as i'm overwhelmed about cleaning. And by cleaning I mean actually getting rid of things, not just moving things around. I am very capable of parting with possessions... i'm just too lazy to start.

Now, I ADMIRE minimalism. I really do. And watching examples of minimalism has the opposite effect on me that watching a hoarding show does. I see examples of minimalism and then I feel really bad about myself. I suppose if I were to tell myself to "not feel bad" after watching a show about minimalism, good health, or other admirable behaviors, then it would only be fair to tell myself "But don't forget that you SHOULD still feel bad" after watching their opposites.

But behaviors like hoarding seem to only be a problem when the negative effects are visible to others. When a house is overflowing with stuff and there are no floor or surface areas left, that's when we say "DAMN! THAT'S MESSED UP!" However, we don't say anything in the early stages. I often think about how organization is kind of a way of enabling hoarding. For example, a giant stack of old bills and receipts stacked on top of the microwave makes a viewer say "Why don't you just throw those out?" However, put them in files and sort those into a filing cabinet, and suddenly that's responsible behavior. We don't ask to see the dates on those bills, because they look like they are where they belong. The same thing goes for clutter. Does it make it okay to have stuff you don't need by organizing it into boxes, labeling those boxes, and then stacking them on nice shelves in your basement?

That's what makes me think perception is about space, not behavior. If you walked into an immaculately clean home, you might not think there is anything wrong. What you don't see is that the owners of that home might have 3 storage units full of stuff they "cleaned" out of their house. Without the storage units, the same amount of stuff might have looked concerning in that home.

And what's up with collections? Where is the line in the sand between collecting things and hoarding? That again seems to fall into the realm of perception. For example, i've never seen any guitarists looked at negatively for having 12 guitars, even though you can only play one at a time. A home library with a large collection of books is considered elegant, but without the shelves, a stack of boxes filled with books makes you ask "why don't you just drop those off at Goodwill?" It would seem the organization of "stuff" absolves it from being clutter, even though it's the same behavior.

So am I a hoarder because I own things that don't constantly bring me joy or function? Would the answer be "no" if I move into a larger home? Would the answer be "yes" if I moved into a smaller home?

I don't think i'm a hoarder as much as i'm overwhelmed about cleaning. And by cleaning I mean actually getting rid of things, not just moving things around. I am very capable of parting with possessions... i'm just too lazy to start.

When I was in 1st grade, I peed my pants in the middle of class. I don't remember it that well (I was only 6 years old). I remember my mom picking me up and taking me home early that day. At the time I thought "Wow, I sure am lucky mom needed me to come home early, today of all days."

REGARDLESS, one of two things must have happened:

I'd like to also note that I thought I "got away with it." Mom played it off like I must have sat in something wet. My teacher never acknowledged it to me.

It might be 29 years too late, but thank you Mrs. Moody and Mom for saving me from psychologically permanent embarrassment damage.

REGARDLESS, one of two things must have happened:

- My peers realized this was an embarrassing accident and never mentioned it ever again. You know, because 6-year-olds are super polite and always think about others and never tease each other.

...or... - My teacher did some ninja shit to make sure the other kids in class didn't notice, while getting me out of there.

I'd like to also note that I thought I "got away with it." Mom played it off like I must have sat in something wet. My teacher never acknowledged it to me.

It might be 29 years too late, but thank you Mrs. Moody and Mom for saving me from psychologically permanent embarrassment damage.

I just finished reading The Total Money Makeover by Dave Ramsey. It was a book I had initially intended to avoid, due to the author’s insistence on religious importance and his conservative attitude. However; after reading it, i’ve reached the conclusion that it’s 50% solid money advice, 48% experience-based opinions, 1% conservative, and 1% religious. I do not regret reading it. I will pick and choose from it, but I will pick most of it. It’s mostly common sense, structured into a very simple formula for getting out of debt, building a savings, and investing in the future.

I told my brother that I was going to start handling my family’s money. My wife had recently decided that budgeting and paying bills was going to be my new job and I was excited to take on the task. My brother, a catholic conservative, suggested I look into Dave Ramsey’s radio show for advice on money. I did, and was disappointed to hear the show start with a bible quote, contain a few snarky comments about the government, a few pitches at selling things, and ending with his sign-off “The only way to financial peace is to walk daily with the prince of peace, Christ Jesus.” Yeah, I wasn’t impressed. This guy must be selling snake oil to people who watch Fox News all day. But out of fear of being close-minded, I gave the podcast a few more tries, so I could tell my brother with full confidence that it was all bullshit. As i listened, forcing my mind to be open, I started to notice that the system he used, which he calls “baby steps,” sounded pretty underwhelming. That’s my weakness. I’m not good at taking on overwhelming tasks. Giving me a simple blueprint that turns the overwhelming task of financial freedom into something with small attainable milestones… well, now you’re speaking my language. I went to the used bookstore and picked up a copy of his steps to getting out of debt and building wealth: The Total Money Makeover. Ironically, I paid for it with a credit card.

The religious part of Dave Ramsey and his financial advice is not something I completely disagree with, as an Atheist. I don’t think it’s the word of god, but I sort of agree with it. He constantly reminds his listeners and his readers about the second half of Proverbs 22:7, which is “...and the borrower is slave to the lender.” This gives Dave the fuel to “preach” about finance. As with most faith-based teachings, it’s not up for discussion. His mind is made up that the bible teaches that you should not have any debts. Not credit cards, not car payments, not student loans, not mortgages. This gives him a REASON. More likely, it gives him the excuse that he’s not doing all this for book sales, but rather he’s evangelizing. Whatever. If he’s going to preach about money, his audience is going to be the sheep who flock to a sheppard. It’s actually pretty genius. Trying to preach anything to atheists is like trying to herd cats. Naturally his audience is going to be faith based people, and so a bible quote here and there is going to make what he’s saying the authority on the subject. You don’t have to agree with it. If you’re not afraid of borrowing money and paying interest, you can simply disregard Dave’s “commandment” and carry on with the rest of his advice. It is, however, the foundation to his principles. But that’s the extent of the religious aspect. Pretty much just that one bible quote.

Yes, he also suggests you tithe. If you are religious, you know this as giving money to the church. Watch how easy this is: If you aren’t religious, don’t give money to the church. Feel free to give money to charities instead. Or don’t. There, crisis avoided. You can still read his financial advice.

After I got about halfway into the book, I checked back in with my brother. It turns out my brother had not read the book and he wasn’t following the baby steps. As I explained to him the rules suggested in the book, it became clear that my brother actually didn’t agree with Dave Ramsey on almost anything. So I asked him “Why did you recommend this guy to me if you don’t agree/follow his advice?” to which my brother responded “Well, I just like listening to him tell the people who call into his radio show to get their ass off the couch and get a damn job.” It’s an attitude thing. That whole “grit” thing about pulling yourself up by your bootstraps is just audio-porn to hardcore conservatives convinced that poverty exists because of laziness and bad priorities. I’m not even getting into that debate right now. But it became clear why conservative people like this guy. Here’s the thing, though: “Spending less money than you make” and “working hard” are not exclusively conservative concepts. So, in that sense, I’d say nothing about this book is “conservative.” Dave thinks you should give the federal government as little taxes as possible. That also means that you should give the federal government every dollar you are required to. I don’t know a single democrat that tries to pay more taxes. So again, this book isn’t conservative. He never mentions what tax rates SHOULD be, but only that you should pay them. Just not a penny more than you legally have to.

This book is strange in that it is 225 pages long but everything you want to learn can be summed up in a pretty short list. He spends the first half of the book just trying to convince you that debt is bad. If you already agree, you can skip to chapter 6. It also is filled with stories of families who have already followed the steps and are telling their story (this book is as old as I am and has been reprinted and updated with these stories many times). If you’re like “Yeah, I get it, it has worked for people” then you can skip those too. They are scattered everywhere throughout the book, so this book reads pretty fast. There are also several full pages of blank budgeting forms for you to use like a worksheet, so again, the actual meat and potatoes of this book is pretty short. Here, look how short I can summarize it:

I told my brother that I was going to start handling my family’s money. My wife had recently decided that budgeting and paying bills was going to be my new job and I was excited to take on the task. My brother, a catholic conservative, suggested I look into Dave Ramsey’s radio show for advice on money. I did, and was disappointed to hear the show start with a bible quote, contain a few snarky comments about the government, a few pitches at selling things, and ending with his sign-off “The only way to financial peace is to walk daily with the prince of peace, Christ Jesus.” Yeah, I wasn’t impressed. This guy must be selling snake oil to people who watch Fox News all day. But out of fear of being close-minded, I gave the podcast a few more tries, so I could tell my brother with full confidence that it was all bullshit. As i listened, forcing my mind to be open, I started to notice that the system he used, which he calls “baby steps,” sounded pretty underwhelming. That’s my weakness. I’m not good at taking on overwhelming tasks. Giving me a simple blueprint that turns the overwhelming task of financial freedom into something with small attainable milestones… well, now you’re speaking my language. I went to the used bookstore and picked up a copy of his steps to getting out of debt and building wealth: The Total Money Makeover. Ironically, I paid for it with a credit card.

The religious part of Dave Ramsey and his financial advice is not something I completely disagree with, as an Atheist. I don’t think it’s the word of god, but I sort of agree with it. He constantly reminds his listeners and his readers about the second half of Proverbs 22:7, which is “...and the borrower is slave to the lender.” This gives Dave the fuel to “preach” about finance. As with most faith-based teachings, it’s not up for discussion. His mind is made up that the bible teaches that you should not have any debts. Not credit cards, not car payments, not student loans, not mortgages. This gives him a REASON. More likely, it gives him the excuse that he’s not doing all this for book sales, but rather he’s evangelizing. Whatever. If he’s going to preach about money, his audience is going to be the sheep who flock to a sheppard. It’s actually pretty genius. Trying to preach anything to atheists is like trying to herd cats. Naturally his audience is going to be faith based people, and so a bible quote here and there is going to make what he’s saying the authority on the subject. You don’t have to agree with it. If you’re not afraid of borrowing money and paying interest, you can simply disregard Dave’s “commandment” and carry on with the rest of his advice. It is, however, the foundation to his principles. But that’s the extent of the religious aspect. Pretty much just that one bible quote.

Yes, he also suggests you tithe. If you are religious, you know this as giving money to the church. Watch how easy this is: If you aren’t religious, don’t give money to the church. Feel free to give money to charities instead. Or don’t. There, crisis avoided. You can still read his financial advice.

After I got about halfway into the book, I checked back in with my brother. It turns out my brother had not read the book and he wasn’t following the baby steps. As I explained to him the rules suggested in the book, it became clear that my brother actually didn’t agree with Dave Ramsey on almost anything. So I asked him “Why did you recommend this guy to me if you don’t agree/follow his advice?” to which my brother responded “Well, I just like listening to him tell the people who call into his radio show to get their ass off the couch and get a damn job.” It’s an attitude thing. That whole “grit” thing about pulling yourself up by your bootstraps is just audio-porn to hardcore conservatives convinced that poverty exists because of laziness and bad priorities. I’m not even getting into that debate right now. But it became clear why conservative people like this guy. Here’s the thing, though: “Spending less money than you make” and “working hard” are not exclusively conservative concepts. So, in that sense, I’d say nothing about this book is “conservative.” Dave thinks you should give the federal government as little taxes as possible. That also means that you should give the federal government every dollar you are required to. I don’t know a single democrat that tries to pay more taxes. So again, this book isn’t conservative. He never mentions what tax rates SHOULD be, but only that you should pay them. Just not a penny more than you legally have to.

This book is strange in that it is 225 pages long but everything you want to learn can be summed up in a pretty short list. He spends the first half of the book just trying to convince you that debt is bad. If you already agree, you can skip to chapter 6. It also is filled with stories of families who have already followed the steps and are telling their story (this book is as old as I am and has been reprinted and updated with these stories many times). If you’re like “Yeah, I get it, it has worked for people” then you can skip those too. They are scattered everywhere throughout the book, so this book reads pretty fast. There are also several full pages of blank budgeting forms for you to use like a worksheet, so again, the actual meat and potatoes of this book is pretty short. Here, look how short I can summarize it:

- Make a budget, get frugal, and save up $1000 for an emergency fund.

- List all debts, except mortgage, in order from smallest amount to largest. Pay minimums on all but the smallest. Pay as much as you can at the smallest until it’s gone. Repeat until no debts remain, other than your mortgage.

- Increase your $1000 emergency fund into 3-6 months of expenses.

- Start putting 15% of your gross income toward retirement.

- Save for your kid’s college

- Start paying off your house early.

- Invest more if you want to and become financially generous.

That’s basically it. There are a lot of details for each step, but you get it. I nice little system to set goals, feel accomplished, and stay on target. It’s not rocket science. Nothing here is probably blowing your mind. It’s just nice to see the path spelled out in black and white. Do this, then do that. A big takeaway for me is just having one thing to focus on at a time. If I start trying to save for my kids college, my retirement, my emergency fund, a car, a house, a vacation…. All at the same time, it will be either overwhelming, or it will seem like there isn’t enough money in the budget to fund anything fast enough. Just being given the permission to temporarily stop investing into everything and instead just focus on one thing at a time, is a big weight off my shoulders. With his method, you do one thing at a time, you do it as fast as possible, and then you never have to do it again. The idea that you haul ass now and go 100% toward one goal at a time gives you a momentum to keep going. And the most rewarding goal would be to have no payments toward any debts, have a bunch of money in savings, and do whatever the hell you want to with your money. Dragging it out just means waiting longer to be able to do whatever you want.

An important thing to note is that these baby steps will not work if you have an income problem. It's another black and white formula: If you're having money trouble, you either spend too much, or you make too little (or both). He doesn't go into what "too much" and "too little" is. So if you are living under the poverty line, making less money than a living wage, these steps aren't likely going to help you. Making more money is going to help you. This is not a book about how to make more money. It's not a book about how to spend less. He gives suggestions, like not paying more than 25% of your monthly income after taxes on rent/mortgage. He suggests selling your car if it's not paid off. He suggests getting a second job delivering pizzas. I can't in good conscience tell a single mother already working 2 jobs that this book is going to help at all. And if you make over $100,000/year, this shouldn't be even remotely challenging for you.

In conclusion, I pretty much recommend this book to anyone who is interested in making a plan and setting goals to getting out of debt and saving money for the future. It’s not religious or conservative enough to disregard the whole thing. And if you don’t want to buy his book, you can read all about the baby steps for free on his website. https://www.daveramsey.com/baby-steps/

An important thing to note is that these baby steps will not work if you have an income problem. It's another black and white formula: If you're having money trouble, you either spend too much, or you make too little (or both). He doesn't go into what "too much" and "too little" is. So if you are living under the poverty line, making less money than a living wage, these steps aren't likely going to help you. Making more money is going to help you. This is not a book about how to make more money. It's not a book about how to spend less. He gives suggestions, like not paying more than 25% of your monthly income after taxes on rent/mortgage. He suggests selling your car if it's not paid off. He suggests getting a second job delivering pizzas. I can't in good conscience tell a single mother already working 2 jobs that this book is going to help at all. And if you make over $100,000/year, this shouldn't be even remotely challenging for you.

In conclusion, I pretty much recommend this book to anyone who is interested in making a plan and setting goals to getting out of debt and saving money for the future. It’s not religious or conservative enough to disregard the whole thing. And if you don’t want to buy his book, you can read all about the baby steps for free on his website. https://www.daveramsey.com/baby-steps/

I recently became interested in learning more about compound interest. I had read something about how Bill Gates has so much money that he earns over $100/second, making the act of picking up a $100 bill off the ground technically a bad investment of his time (i'm still trying to make sense of that logic).

But $100 a second? That's $6,000/minute. $360,000/hour. $8,640,000/day. $3.15 BILLION/year! That's not money he is making for working. That's compound interest earned on just having a lot of money. And good for him, ya know? I'm not hating on him for being wealthy. But those numbers are outside the realm of reality as I know it.

It got me thinking about how simply borrowing a shit-ton of money could change someone's life. Interest-free, of course. And therein lies the problem. Borrowing a shit-ton of money without paying interest on it is in essence receiving free money in the form of interest. No one is going to lend you money without interest, because no one is going to just give you free money... right?

Everything beyond this point requires that 6% ROI that is used in the above example. I realize that the market goes up and down, so you can't lock in amazing returns. But just go with it...

What if I asked you to give me 16¢? That entails me borrowing $2.63 from you for one year, interest-free, and you missing out on 16¢ of interest. You wouldn't benefit in any way, but so what? It's 16¢... no big deal. Sure, why not? Right? I'll come back to this later.

So it's very possible I could be wrong on these calculations, but check this out:

Let's say Mr Gates lent me $19,811,321 (interest free) for a year, I'd earn about one million dollars in interest. If he was nice enough to lend it to me for 13 years, with compound interest I would have earned $22,444,805, after paying Bill back. With that money, I could keep $2.6 million, and give that same loan of $19,811,321 to someone else. The interest I would keep collecting on the $2.6 million would be about $156,000/year to live on for the rest of my life. And then after 13 years, I get my $19.8 million loan back, and I can loan it out again to someone else. So every 13 years my estate creates this opportunity for someone else, and every 13 years their estates do the same.

Let's say Bill likes the idea too, so he also does the loan to someone new EVERY year. How fast would that spread? I'm sure there is a simple math equation for it, but basically you start with ONE REALLY RICH FAMILY, and then every 13 years (forever) they make a different family really rich, and every 13 years (forever) those families make more really rich families.

So now imagine for a moment that we don't bother Mr Gates about this. His time is so valuable, I wouldn't be able to afford more than a few seconds of it, anyway. So from every working person paying income taxes in the USA (124.73 million people) let's say we all had $2.67 withheld from us, and then GOT IT BACK on our tax returns... 124.73 million x $2.67 = $333 million. Collect 6% interest from that, then pay everyone back. Now you have ~$20 million to start the process. No need for Bill Gates. You would just need enough voters to agree that it's worth 16¢ of their interest (nothing out of pocket) to roll a boulder down a hill that would continuously crush poverty.

And regarding that unstable rate of return: The idea is the transactions wouldn't necessarily occur annually. They would occur as often as needed to hit the amounts. So when the markets up, payouts would be faster. Down, slower.

But $100 a second? That's $6,000/minute. $360,000/hour. $8,640,000/day. $3.15 BILLION/year! That's not money he is making for working. That's compound interest earned on just having a lot of money. And good for him, ya know? I'm not hating on him for being wealthy. But those numbers are outside the realm of reality as I know it.

It got me thinking about how simply borrowing a shit-ton of money could change someone's life. Interest-free, of course. And therein lies the problem. Borrowing a shit-ton of money without paying interest on it is in essence receiving free money in the form of interest. No one is going to lend you money without interest, because no one is going to just give you free money... right?

Everything beyond this point requires that 6% ROI that is used in the above example. I realize that the market goes up and down, so you can't lock in amazing returns. But just go with it...

What if I asked you to give me 16¢? That entails me borrowing $2.63 from you for one year, interest-free, and you missing out on 16¢ of interest. You wouldn't benefit in any way, but so what? It's 16¢... no big deal. Sure, why not? Right? I'll come back to this later.

So it's very possible I could be wrong on these calculations, but check this out:

Let's say Mr Gates lent me $19,811,321 (interest free) for a year, I'd earn about one million dollars in interest. If he was nice enough to lend it to me for 13 years, with compound interest I would have earned $22,444,805, after paying Bill back. With that money, I could keep $2.6 million, and give that same loan of $19,811,321 to someone else. The interest I would keep collecting on the $2.6 million would be about $156,000/year to live on for the rest of my life. And then after 13 years, I get my $19.8 million loan back, and I can loan it out again to someone else. So every 13 years my estate creates this opportunity for someone else, and every 13 years their estates do the same.

Let's say Bill likes the idea too, so he also does the loan to someone new EVERY year. How fast would that spread? I'm sure there is a simple math equation for it, but basically you start with ONE REALLY RICH FAMILY, and then every 13 years (forever) they make a different family really rich, and every 13 years (forever) those families make more really rich families.

So now imagine for a moment that we don't bother Mr Gates about this. His time is so valuable, I wouldn't be able to afford more than a few seconds of it, anyway. So from every working person paying income taxes in the USA (124.73 million people) let's say we all had $2.67 withheld from us, and then GOT IT BACK on our tax returns... 124.73 million x $2.67 = $333 million. Collect 6% interest from that, then pay everyone back. Now you have ~$20 million to start the process. No need for Bill Gates. You would just need enough voters to agree that it's worth 16¢ of their interest (nothing out of pocket) to roll a boulder down a hill that would continuously crush poverty.

And regarding that unstable rate of return: The idea is the transactions wouldn't necessarily occur annually. They would occur as often as needed to hit the amounts. So when the markets up, payouts would be faster. Down, slower.

Author

Hi, i'm John(ny). I'm a middle-aged(?) husband and dad. I have a video/photo business that fills in all the gaps.

I grew up in Greenfield, WI (which is a suburb of Milwaukee; Excellent).

In my life i've taken interest is many things, including songwriting, photography, video... just trying to make stuff in general.

If you're still reading this, please know that I love you so hard right now.

Archives

August 2023

January 2019

August 2018

April 2018

January 2018

May 2017

April 2017

March 2017

November 2016

RSS Feed

RSS Feed